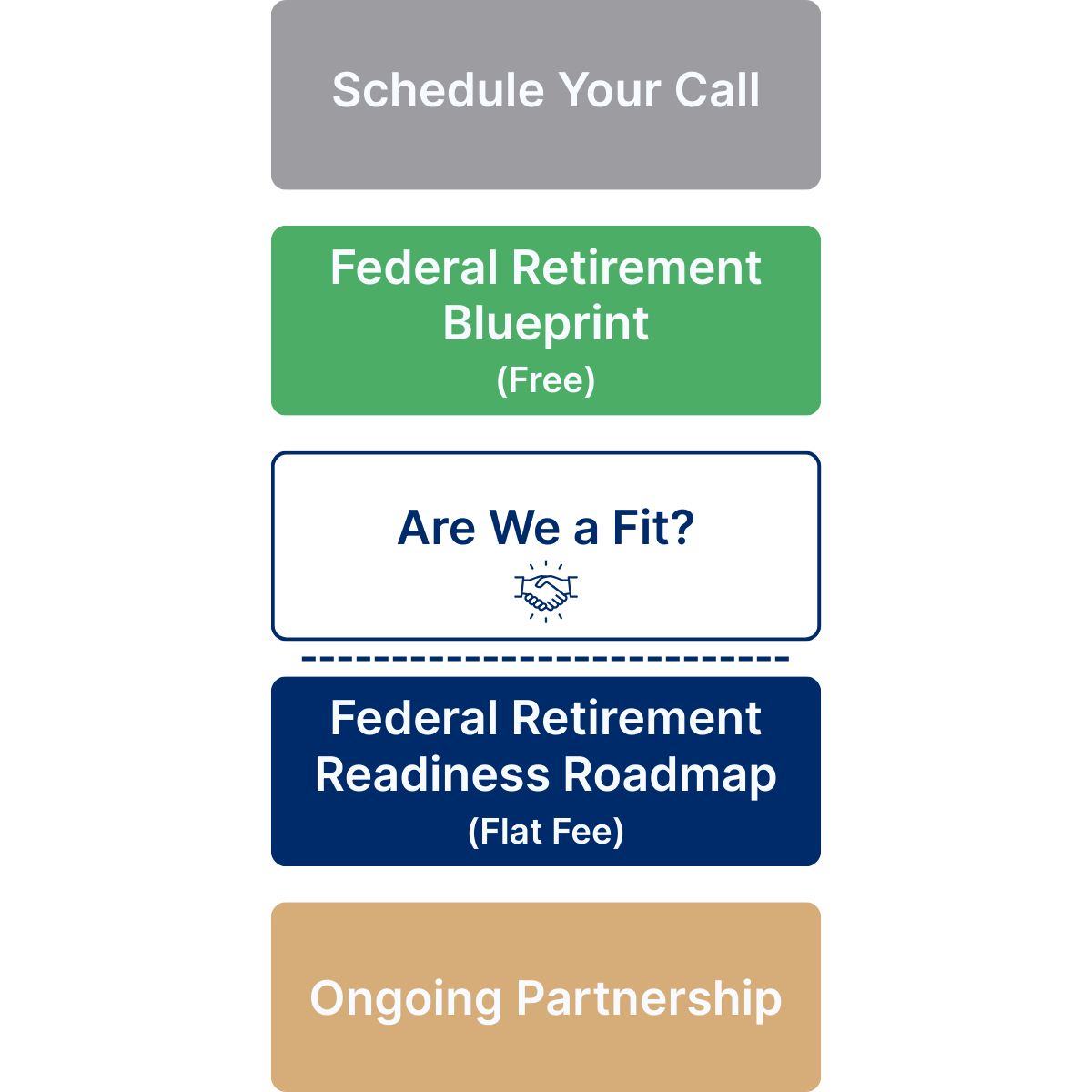

From free Federal Retirement Blueprint to ongoing guidance: a simple 3-step process

Here's how we work together:

Step 1: Federal Retirement Blueprint (complimentary)

We start with a free one-on-one Federal Retirement Blueprint for federal employees within 5–10 years of retirement. You’ll see where you stand with your FERS/CSRS pension, TSP, Social Security, and FEHB, and whether you’re truly on track.

Step 2: Federal Retirement Readiness Roadmap (flat fee)

If you want a deeper, detailed plan, we move into a flat-fee Federal Retirement Readiness Roadmap. Over 3–4 months, we build your retirement income, investment, and tax plan together.

Step 3: Ongoing Partnership

After your Roadmap, you can choose ongoing support through investment management (for a percentage of assets we manage) or a planning-only relationship if you prefer to keep managing investments yourself.

Your life.

Your benefits.

Your plan.

At GT Wealth, your life isn’t just part of the plan, it’s the foundation.

Our process starts by understanding what truly matters to you and your family when you want work to become optional, how you want to spend your healthiest years, and how you want your FERS pension, TSP, Social Security, and FEHB to support that life.

From there, we follow a simple three-step framework:

- A free Federal Retirement Blueprint to see where you stand,

- A flat-fee Federal Retirement Readiness Roadmap to build your detailed plan, and

- Ongoing support through investment management or planning-only.

You’ve worked hard to build your federal benefits and savings. Our job is to help you use them to create the freedom, security, and fulfillment you want in this next chapter.

Frequently Asked Questions

Yes, we can. Our firm is equipped to meet with clients and potential clients through the video conferencing software, Zoom. Each meeting is protected by a unique password and we adhere to the strict security guidelines necessary to protect your privacy.

GT Wealth is an independent, fee‑only fiduciary firm. That means I’m paid only by the clients I serve, I don’t earn commissions or product kickbacks, and my advice must be in your best interest.

Here’s what working together actually looks like:

- We start with your Federal Retirement Blueprint (complimentary). One conversation to understand your benefits, savings, and goals, and to see whether there’s a real decision to be made around retirement.

- If it’s a fit, we move into a Federal Retirement Readiness Roadmap (flat fee). Over several Zoom meetings, we build your detailed retirement income, investment, and tax plan together, based on your FERS/CSRS pension, TSP, Social Security, and FEHB.

- From there, we stay in your corner through an ongoing partnership.

Most clients meet with me at least twice per year, with email access in between, so we can adjust as markets, tax laws, and your life change.

I’m based in Pennsylvania but work virtually with federal employees across the country.

The goal is simple: you feel confident, clear, and in control of your retirement decisions, not guessing or going it alone.

I keep my fees simple, transparent, and directly tied to the work I do for you.

There are three ways I work with federal employees and families:

1. One-time Federal Retirement Readiness Roadmap

If you want a detailed retirement and tax plan before deciding on an ongoing relationship, we start with a one-time project.

Flat planning fee: $2,500

Covers a 3–4 month process where we build your retirement income, investment, and tax plan together, based on your actual FERS/CSRS benefits, TSP, Social Security, and FEHB.

If you decide to move forward with ongoing investment management within a set period after completing your Roadmap, I apply a credit toward your first year’s advisory fees. I’ll explain exactly how that works before you decide.

2. Ongoing Investment Management (AUM)

If you’d like me to manage your investments and coordinate your retirement and tax planning on an ongoing basis, I charge a percentage of the investments I manage, debited directly from your accounts:

- 1.25% on the first $500,000

- 1.00% on the next $500,000

- 0.75% from $1,000,000 to $3,000,000

- 0.50% on anything over $3,000,000

This fee includes retirement income planning, investment management, tax planning, and coordination with your other professionals. There are no separate fees for meetings, emails, or ongoing advice.

3. Planning-Only Relationship

If you prefer to keep managing your own investments (for example, leaving assets in the TSP), we can work together on a planning-only basis.

Flat planning fee: $2,500 for your initial Federal Retirement Readiness Roadmap

Then an ongoing planning retainer starting at $300 per month, depending on complexity

This option focuses on retirement income, tax strategy, and major decision support, while you implement the investment piece yourself.

At GT Wealth, I’m fee-only and act as a fiduciary at all times:

- I do not receive commissions, kickbacks, or referral fees

- I am paid only by the clients I serve

- You will always know the fee before you agree to anything

The goal is simple: you should understand exactly how I’m compensated and feel confident that my advice is aligned with your best interest.

My goal is to help you experience more freedom and less stress about money, especially around the decisions that are unique to federal employees.

That means taking retirement planning off your plate so you can focus on the life you want to live.

I help clients with:

- Federal retirement planning built around your vision for life after federal service (including FERS/CSRS, TSP, Social Security, and FEHB)

- Investment management aligned with your goals and risk tolerance, coordinating TSP and outside accounts

- Proactive tax planning so you keep more of what you’ve earned through smarter withdrawals, Roth strategies, and timing decisions

- Estate and legacy planning that reflects what matters most to you and your family

- Insurance and risk review (life, disability, long-term care) so you’re protected without overpaying

- Cash flow and spending plans to keep your lifestyle sustainable and flexible throughout retirement

And anything else it takes to help you move forward with clarity, confidence, and control in this next chapter.

Yes, and it's a core part of what we do.

Our goal is to reduce your total lifetime tax bill, not just react at filing time. We take a proactive approach by helping you identify opportunities to optimize how you earn, spend, and invest so more of your money stays working for you.

While we don’t prepare or file your tax return, we collaborate with your CPA or tax professional to make sure the strategy and execution are aligned.

Your investments are held at Charles Schwab, an independent custodian. That means your accounts remain in your name, fully owned and accessible by you.

We serve as your advisor with limited authority to manage those accounts on your behalf always with transparency and your permission. We don’t work for Schwab, and we don’t earn commissions. Our role is to guide you with objective advice that puts your goals, values, and future first.